Partners

for Growth in the Middle East

Arboris invests primarily in companies or JVs with strong fundamentals and a potential for accelerated growth through strategic and operational change

01 The Company

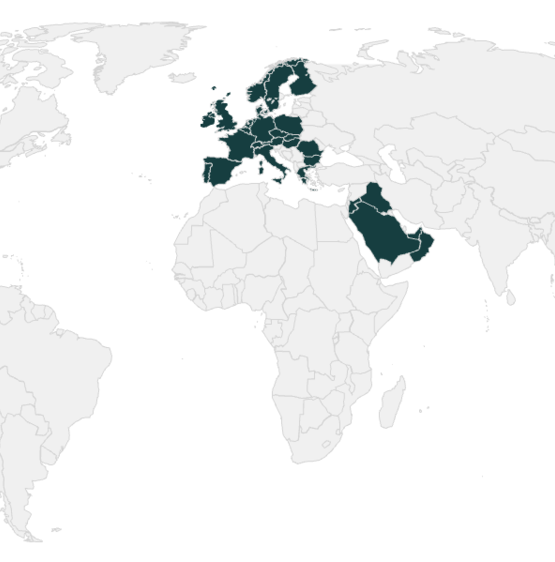

We invest in businesses in the Middle-East & Europe

Headquartered in Dubai, Arboris is an investment firm focused on private equity and joint venture investments in the Middle East and Europe. Founded by a team of investment professionals and entrepreneurs, we invest our own capital and seek to unlock growth alongside our partners by providing business development support and strategic guidance

02 Our Focus

We leverage our in-depth understanding and experience of the Middle-East to generate superior returns alongside our partners

Private Equity Investment

We invest alongside entrepreneurs in small and medium-sized businesses which are leaders in their field but operating below their full potential

Joint Ventures

We structure and invest in joint-ventures with global technology or industrial partners seeking to expand in the Middle East

03 Our Values

What guides us as we engage with our partners and portfolio companies

Long-Term View

As we invest our own capital, we are not bound by third-party investors with short-term return expectations allowing us to deliver long-term value creation strategies

Creating Value

Beyond just providing capital, we leverage on our decades of investment experience and our network of experts in the region and take an active part in business development, strategic guidance and talent recruitment

Flexibility

We understand our partners each have different requirements and we strive to adapt to circumstances committing to explore different stages of growth as well as alternative investment and governance structures

04 Investment Criteria

We target platforms generating strong growth with strong regionalization potential in the Middle East

Management

We invest alongside management teams with a history of profitable growth and value creation and demonstrating significant industry experience

Transaction Type

We entertain various potential transactions structures such as management buyouts, buy & builds, family succession and corporate divestitures

Regionalization

We prioritize opportunities with strong regionalization potential as a lever to accelerate top-line growth in the Middle-East

05 Preferred Sectors

While we are largely sector agnostic in looking for investments, our team has historically built a strong track record in four key sectors

Business Services & Technology

Companies operating in large and fragmented markets, requiring improvements in efficiency and whose growth is driven in part by technology

Healthcare

Companies driven by demographic factors, operating in niche submarkets and experiencing increased demand for consumerisation and quality of care

Consumer

Companies operating in fast-growing and fragmented markets, experiencing increased demand and whose growth can be driven by digital innovation

Industrials

Companies operating in niche markets protected by entry barriers and proprietary technology, possessing attractive regional expansion opportunities

06 Our Leadership Team

Our team is composed of professionals with diversified backgrounds in investment banking, private equity and entrepreneurship

Richard Chalhoub

Chairman

Xavier Remond

Chief Executive Officer

Mashrur Nabi

Chief Operating Officer

Get in touch

We are happy to start a conversation with you and discuss your growth objectives

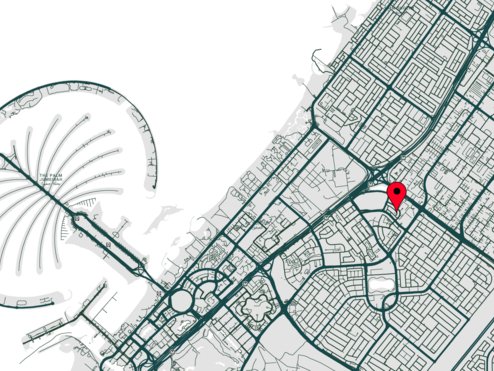

Address

Elite Business Tower, Office 209, Barsha 1, Dubai, United Arab Emirates

Telephone

+971 4 22 71 662

contact@arboris.ae